What determines the value of a cryptocurrency?

Cryptocurrency has been the new trend over the past few months and everyone is scrambling to get to know more about it. It has been used in dual applications as an investment asset and currency! This has fascinated everyone, especially with the dynamic Elon Musk, Tesla’s CEO, tweeting constantly about it and indirectly determining its prices. So, there is a lot happening in the cryptocurrency world.

Hence, many people are trying to understand it better. Even many countries are considering legitimizing transactions in crypto. For example, Canada has allowed Bitcoin and Ethereum transactions to be legally conducted in their country. Many people have started trading in Bitcoin and you can go URL to know more about this and sign up on trading websites

Is cryptocurrency volatile?

Volatility is the reason for people to be wary of cryptocurrency. They think of it like stocks, with the value of it constantly changing based on the market. This is semi-true. Every cryptocurrency has its own place in the economy. Its value is not connected to anything in particular and depends on the supply and demand of tokens. This aspect is further processed in the blockchain technology independently. The process is not controlled by anyone, hence would be free from any bias or fraud.

There will always be a fixed supply of tokens or cryptocurrency coins and the value wouldn’t differ by much. However, there are a few factors that affect cryptocurrency prices and it is good to keep them in mind to predict the differences.

Factors that affect the value of cryptocurrency.

1. The Demand

Due to the crypto fever affecting everyone, people have started buying cryptocurrency. This increases the market cap of a cryptocurrency thus increasing its value. This occurs because the cryptocurrency supply is highly limited. Also, cryptocurrency is very susceptible to controversies, so its value can go down.

This leads to more people selling and reduces its value even further. Bitcoin suffered a similar fate due to Tesla’s CEO Elon Musk’s statement that Tesla won’t be accepting Bitcoin payments anymore due to environmental concerns. Hence, people sold the Bitcoin they had, and this decreased value considerably. Now, Bitcoin’s prices are highly interconnected with other cryptocurrency prices, so the drop in Bitcoin’s prices led to a crash in the crypto market.

2. Node Count

The node count technically gives an approximation of how many active wallets exist in that crypto network. This information can be obtained on the crypto exchange platform that you use. It is also recorded and updated on the homepage of every currency. This along with the market capitalization contributes to the value of the cryptocurrency.

Higher the market cap, the higher the potential of the cryptocurrency to rise in value. Node count gives an idea of how many people in a community are using that crypto. This would tell you if your cryptocurrency can overcome value plunges or not.

3. Mass Adoption

If a currency is adopted in huge numbers, which means many people have purchased it due to some movement or statement, then the prices can skyrocket. This is again related to the demand and supply factors. Mass adoption movements have been seen before when Reddit users adopted Dogecoin.

Doge was initially created as a joke, but Redditors from some community mass bought it, making its value increase multifold! It is now one of the top cryptocurrencies in the world! Elon Musk also didn’t help things by tweeting regularly about it and raising its value.

4. Inflation

Now, the above factors dealt with crypto almost like an asset. However, cryptocurrency is also a currency and will deviate along with the value of fiat currencies. This is seen during inflation. When the price of a currency increases, Bitcoin prices go down and you can purchase more Bitcoins this way. This also occurs vice versa. About ten years back, Bitcoin cost less and you could purchase more with a few dollars.

However, now Bitcoin’s prices are up and you can purchase even less with the same amount. Hence, the value differs in this way. It gets affected when you use cryptocurrency to shop or buy goods or services.

5. Development Costs

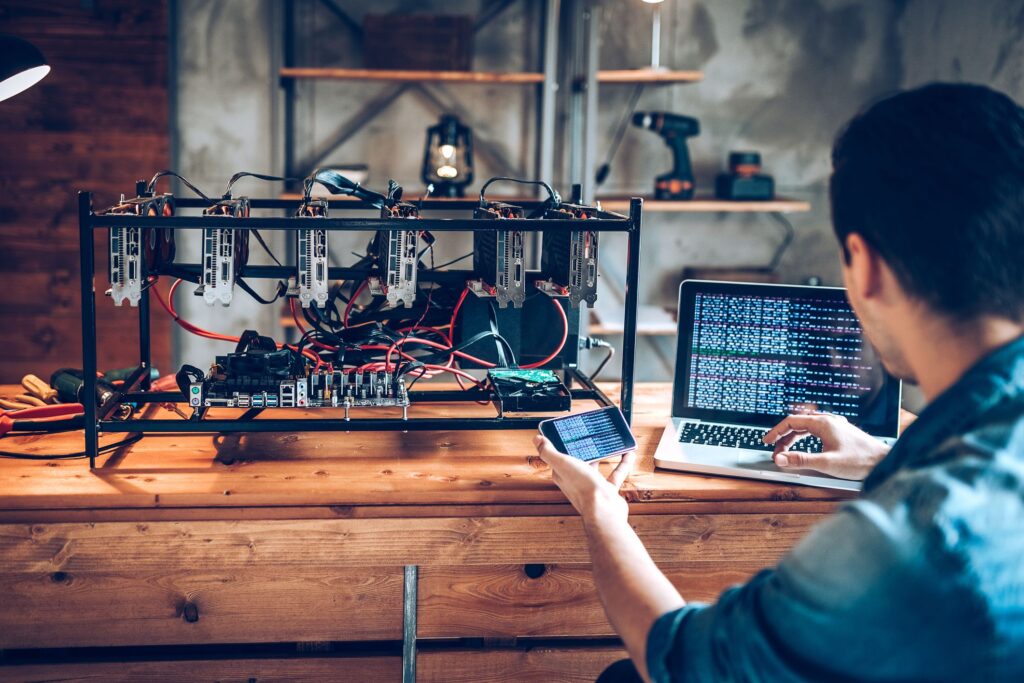

The costs of development and manufacturing are generally very high. Bitcoin, with primitive blockchain technology, actually has a high cost of production. Bitcoin consumes a lot of energy and resources in mining and that is also added to its value. The CPUs required, the cooling systems, the fuel, and the hardware required adds to the value of this cryptocurrency. Bitcoin consumes a lot of electricity. Other altcoins also do, but relatively less.

6. Legalization of Cryptocurrency

While this doesn’t directly affect the prices, the legalization of crypto can impact the demand and supply. If cryptocurrency is legalized and recognized by a government, that means transactions can be conducted easily. Thus, people will invest in crypto and use it in payments. This increases the demand within the country itself and will add more value to the cryptocurrency. When Canada approved Ethereum, the prices soared. The centralization of digital money adds to its value considerably. When China and Russia banned cryptocurrency transactions, a significant plunge in prices was seen.

Conclusion

Cryptocurrency is becoming the more accepted form of payment over the years. The volatility is dropping and the amount of transactions conducted has seen a rise. This trend may continue now that people want more secure and faster means of international payment transactions. The above-mentioned factors significantly affect digital currency values. The governments and banks right now are pondering over whether to completely accept crypto payments or not. You can check out this review for a more thorough insight into this.

The regulation of this can be a bit tricky and this part is what is holding the world back from relying on crypto. Also, people have to be comfortable with cryptocurrency. The volatility is the reason for their hesitance, however, there are now ways to freeze your crypto to fiat, thus you won’t lose money. Keeping an eye on the above factors would help you approximately gauge the values of cryptocurrencies so that you can decide when to sell or buy. Crypto is a new movement, so understanding it would be a step towards progress.